Nakisa serves large enterprises throughout the world, and we have observed the struggles companies have each year-end. The lease accounting year-end audit is a complex and time-consuming process. It is, however, essential for ensuring accurate financial reporting and compliance with regulatory requirements as well as for enterprise cost optimization. To make the entire process smoother, we created this guide on year-end audits where we share our knowledge and best practices that we have observed, especially in recent years with the introduction of the new lease accounting rules.

In this guide, you will learn:

This guide was created by a team of Nakisa experts who has been working side-by-side with global market leaders such as Walmart, Pfizer, Puma, Nestlé, ExxonMobil, Airbus, and other Fortune 1000 companies for the last 5 years. Our clients often have 50,000+ lease agreements they need to manage, and the experts assist them in implementing efficient lease management strategies and meeting regulatory requirements.

1. What a Year-End Lease Administration Audit is, its importance, and challenges

What is the year-end audit for lease accounting?

A financial audit is an independent external examination of an organization’s financial records, transactions, and processes performed by qualified third-party auditors. As part of a year-end audit engagement, auditors may evaluate the accuracy, completeness, and reliability of the lease accounting information. This is done by reviewing and examining selected financial documents and records including lease contracts and schedules.

While lease accounting standards have been in place for several years, many companies continue to face challenges in maintaining accurate records and remaining compliant with accounting standards.

Why is the year-end lease administration audit so important?

The year-end lease administration audit is a critical process that must be conducted accurately. It provides an opportunity for companies to:

Challenges for enterprises

Lease accounting can be a complex and challenging process, especially during year-end audits. It involves tracking and managing lease agreements, calculating payments, and ensuring compliance with accounting standards. The process can become even more complicated for enterprises with large lease portfolios or those that operate in multiple jurisdictions, currencies, and languages.

Let’s see why year-end audits can be difficult for enterprises:

- A high volume of leases: Many enterprises have many leases that need to be accounted for, which can make the year-end audit process complex and time-consuming.

- Complexity of lease terms: Leases can have complex terms and conditions that need to be understood and accounted for correctly. This can lead to errors and inaccuracies in lease accounting, especially if the calculations are done manually.

- Lack of standardization: There may be no standardized approach applied to lease administration and accounting, which can make it challenging for enterprises to ensure consistency and accuracy in their accounting practices.

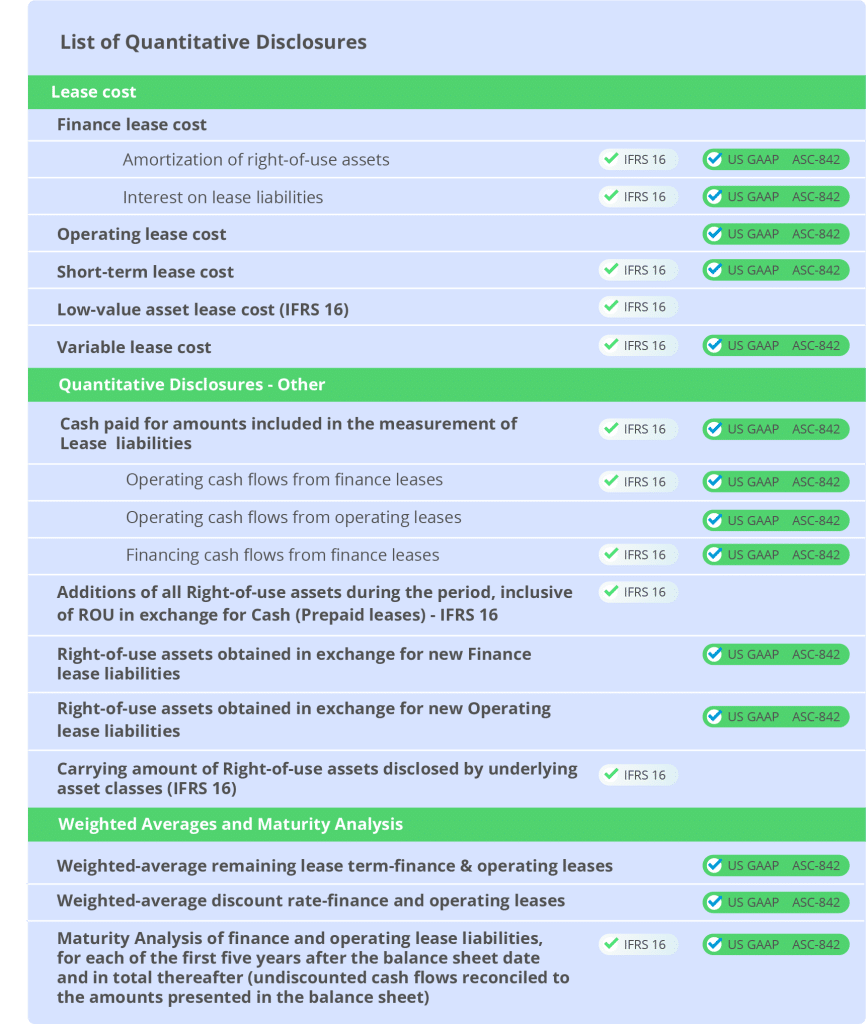

- Changes in accounting standards: The accounting standards keep on evolving and have undergone significant changes in the past five years. Disclosure requirements can get very complicated, especially for entities that need to generate reports in both ASC-842 as well as IFRS-16, largely given the divergences between the 2 standards.

The list of required disclosures for Lease Accounting are listed below per Accounting Standard

- Limited resources: Many enterprises have limited resources and expertise when it comes to lease accounting, which can make it difficult to manage the year-end audit process effectively.

- Technology limitations: Some enterprises may not have the technology infrastructure or tools necessary to manage lease accounting effectively, which can further complicate the year-end audit process. Using spreadsheets or other outdated tools, adding modifications while the data is not centralized in one place, and having several sources of data will result in a cumbersome year-end audit.

- Difficulty to describe and take into consideration complex cases. Lease agreements may get very complex, especially if they are long-term and their terms and conditions have been changing through the years.

By addressing these challenges proactively and leveraging the right tools and expertise, enterprises can streamline the year-end audit process and ensure accurate and compliant lease accounting.

Let’s explore the best practices for preparing for the year-end audit during the year in the next section.

2. How to prepare lease administration documentation throughout the year?

Five rules for calculations during the year

During the year, you need to keep detailed records of all lease contracts and modifications, and regularly review the lease data to ensure accuracy. Here are five rules to follow for a smoother year end-end audit:

- Have one central location for all the detailed records and lease data. Having several sources of unsynchronized information will lead to multiple versions of data which increases the risk of error. Your team will also waste more time looking for and verifying lease information to find the correct version.

- Start shifting the close process: close tasks earlier in the month for month-end close, and earlier in the year for indicative disclosure reporting and year-end audit. This way, the close process will become more continuous.

- Cross-validate critical lease activity and balances in various reports within the subledger and reconcile with consolidated reporting systems.

- Replace labor-intensive tasks that rely on checklists with integrated workflow lease processes across different systems.

- Maintain strong communication with your lease stakeholders, including leaseholders, accounting teams, and auditors. Lease Accounting policies and procedures should be determined by the enterprise with the contribution of all stakeholders involved in the entire life cycle of the leasing processes. They should be formally documented and communicated to the lease accounting staff to ensure consistent application of the determined processes.

Manual calculations: what to consider

Performing these complex calculations in Excel or another manual tool is a monumental task. If you calculate your lease data manually, ensure that you and your team use a standardized format, regularly review and update the calculations and keep detailed records of all calculations, including assumptions or estimates made.

Here is what you should do:

- Identify all Leases: The first step in preparing for a year-end audit under IFRS 16 and ASC 842 is to identify all leases, including operating leases, finance leases, and short-term leases.

- Determine the Lease Term: Under IFRS 16 and ASC 842, the lease term includes any options to extend or terminate the leases that are reasonably certain to be exercised. You will need to review your lease contracts to determine the lease term.

- Calculate the Lease Liability: The lease liability is the value of the lease payments over the lease term. This calculation includes the minimum lease payments and any lease incentives.

- Calculate the Right-of-Use Asset: The right-of-use asset (ROU asset) is the initial measurement of the lease liability plus any lease payments made before the commencement date, any lease incentives received, and any direct costs associated with the lease.

- Record the Lease on Your Balance Sheet: Once you have completed the lease liability and right-of-use asset calculations, you can record the lease on your balance sheet.

Remember that calculating these inputs manually can cause human errors and be time-consuming. Ensure all your lease-related data is in a central repository, including exchange rates, incremental borrowing rates, contract information, termination options, extension clauses, and all other critical data.

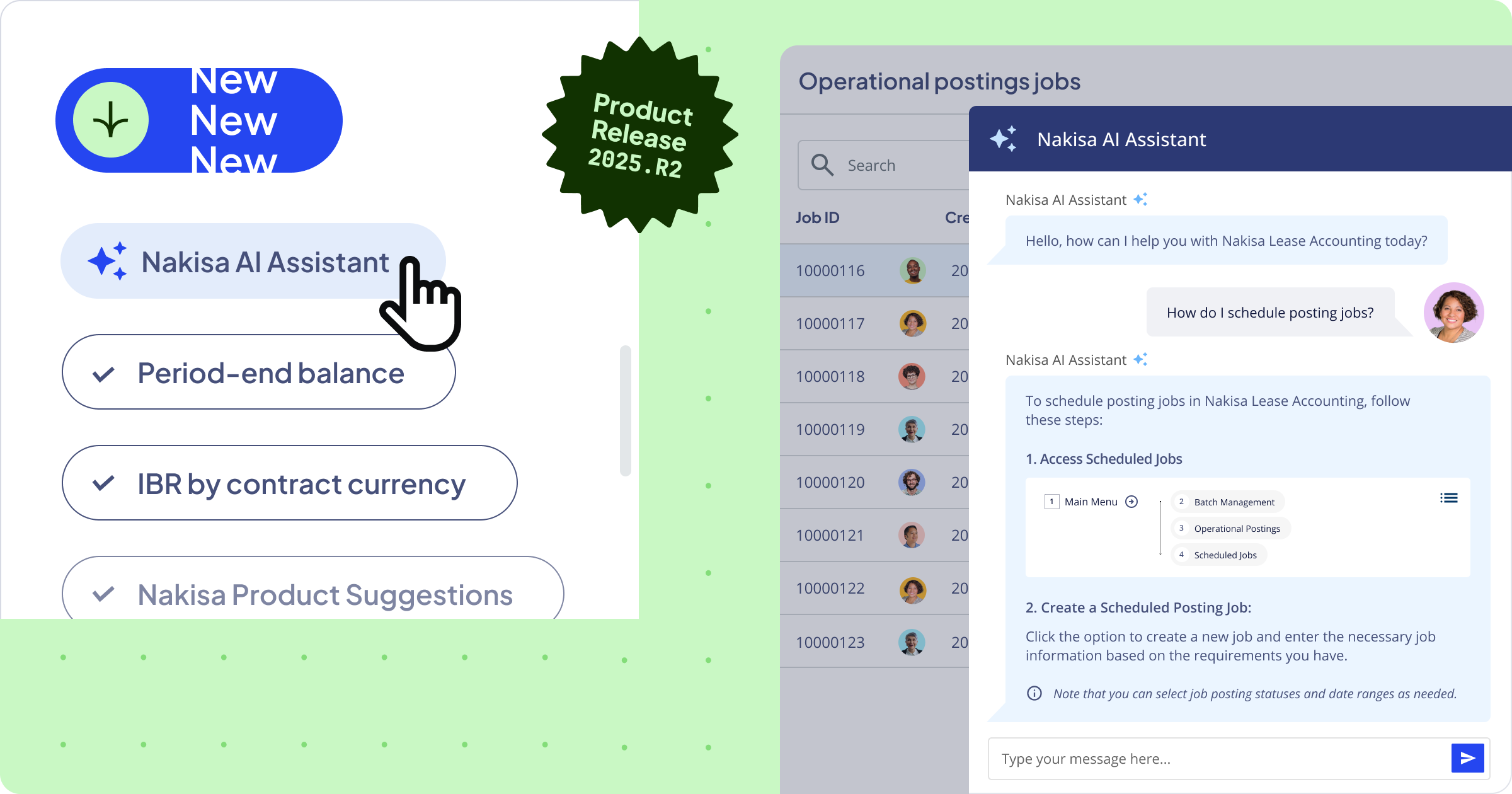

With IFRS 16 and ASC 842 accounting requirements in mind and the large volume of data for enterprise-grade companies, your accounting team may be consumed with many manual calculations during the rush of preparing for the year-end audit. For this reason, large enterprises with significant lease portfolios can only comply with the new standards if they are using enterprise-level lease accounting software with advanced automation.

Benefits of automation

Automating the lease calculation process can offer many advantages such as:

- Improved accuracy and consistency.

- Faster and more efficient data collection.

- Streamlining the audit process, providing auditors with easy access to accurate and up-to-date critical lease data. This can help to minimize audit disruptions and ensure that the process runs smoothly.

- Ensuring compliance with lease accounting standards.

Choosing the software

Automation is a necessity to ensure your year-end audit runs smoothly. Ensure you choose the right software that will best meet the unique requirements of your organization with the involvement of all stakeholders engaged in the leasing process. If you have still not selected a lease accounting solution, or are considering changing to an enterprise solution more aligned with your requirements, you should consider the following:

- Accurate integration with multiple data sources. Pay attention to what ERP systems and other data sources the new software can be connected to in order to ensure a seamless data flow between systems and reduce manual work and errors. Having bidirectional integration instead of unidirectional is necessary as it enables writing back the financial data to original data sources.

- Compliance with lease accounting standards IFRS16, ASC 842 and GASB 87 is a definite requirement for software.

- Security of your data: ensure the software has SOC 1 Type 2 and SOC 2 Type 2. If the software doesn’t have those, it’s important to perform additional internal controls and processes and ensure that the auditors conduct an additional audit to satisfy their obligations. It’s crucial to be 100% sure that only the right users can have access to the system, so discuss with the IT team the policies they have and IT general controls. Look for a solution that can be integrated with your SSO.

- Functionality to capture complex terms and conditions such as prepayments, IDC, free rent period, and more. Supporting complex lease scenarios and complete and accurate calculations will greatly facilitate your day-to-day work and year-end audit.

- Reliability: a solution will need to manage all the leased assets in a single system. While choosing a solution, ensure that it can handle your existing and future performance requirements which could be in the hundreds of thousands of leased assets an enterprise may need.

- Capacity to handle different ledgers and year-end audits per Legal Entity, as well as multi-language and multi-currency features.

- Ability to add lease modifications and reassessments due to various events (impairment, change in terms, or decrease in scope). Don’t forget to check if the solution allows mass lease modification—this feature can save a lot of time and reduce inherent risk of error!

- Ease of use for the end user and intuitive design.

- The ability to cover lessee and lessor accounting needs in the same platform can be a plus if your enterprise subleases assets.

Read more about how to choose the right software for your company in our guide. We also included a feature checklist and RFP Scorecard there!

Overall, having the right lease administration software can help to simplify the year-end audit process, minimize errors and disruptions, and ensure compliance with all relevant accounting standards and regulations.

3. Year-end disclosure reports

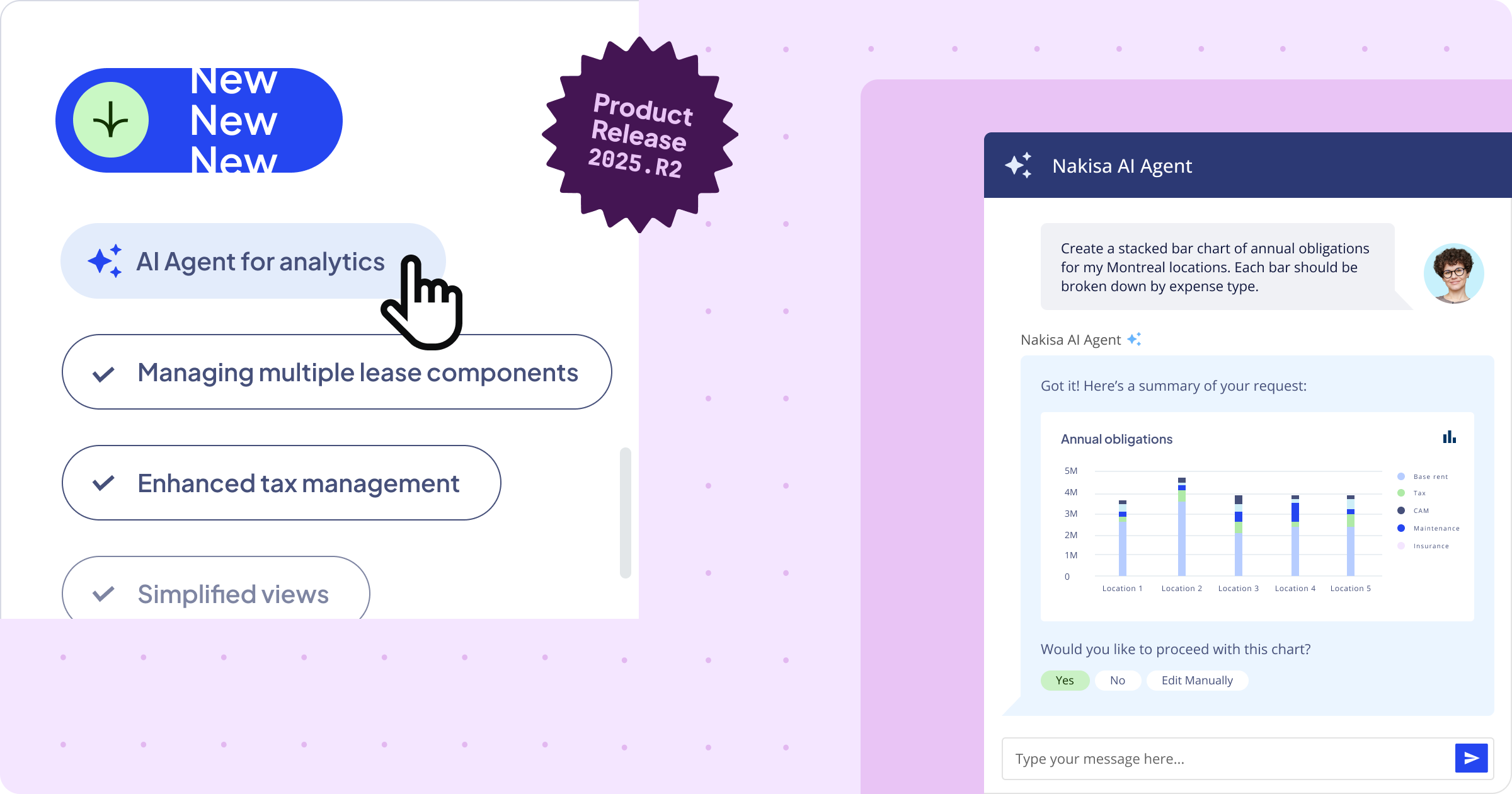

As the fiscal year comes to an end, enterprises need to start preparing their year-end disclosure reports. The purpose of disclosure reports is to provide financial statement users with a foundation for evaluating how leases impact their financial statements through quantitative and qualitative reports.

Disclosure report requirements

Let’s examine some of the key disclosure requirements:

- Lease assets and liabilities: enterprises must disclose the carrying amount of their lease assets and lease liabilities. They also must disclose any additions to the right-of-use assets.

- Maturities of lease liabilities: companies must provide a maturity analysis of their lease liabilities, showing the number of lease payments due in each of the next five years and the total thereafter. In addition, under ASC 842, enterprises must disclose the weighted average remaining lease term and the weighted average discount rate.

- Lease expenses: enterprises must disclose their lease expenses, including depreciation, interest on lease liabilities, operating lease expenses (ASC 842 only), short-term lease expenses, low-value asset lease expenses (IFRS 16 only), and variable lease expenses.

- Lease income: businesses must disclose any income from sub-leasing right-of-use assets and gains or losses arising from sales and leaseback transactions.

- Cash flow: enterprises must disclose cash outflow for leases.

- Qualitative disclosures: companies must disclose a description of the liquidity risk related to leasing liabilities and use of the exemption for short-term and/or low-value item leases.

verall, the disclosure requirements for leases are designed to provide transparency and aid financial statement users to understand the impact of lease activities on an enterprise's financial statements.

Once again, we want to highlight the importance of automation not only for calculations throughout the year but also for producing disclosure reports.

Given the magnitude of requirements under both IFSR 16 and ASC 842, manually producing these reports can be a large undertaking for enterprises. Many large enterprises rely on software solutions for creating their disclosure reports. Using lease administration software will allow the auditors to easily track where the information is coming from and test the accuracy and completeness of the disclosure reports. It greatly reduces the risk of human error and saves time and effort for the team.

Most common issues observed

Risk: differences between subledger and GL

One of the most common problems encountered at year-end is the difficulty reconciling lease expenses and balances coming from your consolidated reporting systems and the disclosure reports coming out of your leasing subledger. Here you can see several possible examples:

- The lease liabilities in your ERP may not reconcile with the maturity analysis report and related lease liability balance in your disclosures coming from the subledger.

- The lease expenses in the quantitative disclosures from your subledger may not reconcile with the lease expenses recorded in your ERP. This could be a result of many factors. ERP accounts may not be control accounts and entries are getting into the accounts that are not part of the subledger and don’t belong in the disclosures.

- The FX remeasurement and translation methodologies, or effective rates and dates for foreign currency accounting used by your ERP may differ from those used in your subledger.

- There may be different month-end cut-off procedures between systems, where certain entries are included in one system and excluded from the other.

Throughout the year, you should be reconciling your lease accounting subledger with your ERPs and consolidated reporting systems. It is not acceptable leaving this until year end, as it typically involves significant time and energy to discover and explain the reconciling differences. Time and energy you don’t have that late in the game! Auditors will be looking to make sure that the disclosure reporting that comes out of your leasing subledger reconciles to specific balances in your Consolidated Financial Reporting. You need to make sure there are no year-end surprises. Throughout the year, you can act upon those differences by not only correcting the entries, but also by establishing stronger controls, such as control accounts dedicated to only subledger entries, and improving consistency in FX methodologies between systems and month-end cut-off procedures. This is only possible with a lease accounting software solution that provides these capabilities, ideally, one which has demonstrated best-of-class integration capabilities to all major ERPs.

Risk: Month-end cut-off errors

There is also a high risk of cut-off errors that is unique to leasing when lease transactions don’t make it into the subledger or GL on a timely basis. This is common in a decentralized environment, and it is often tolerated throughout the year, as delays are simply month-to-month timing errors. However, those delays are not acceptable at year-end. Lease stakeholders need to report on all new lease transactions executed prior to year-end. Returns or buyouts that have occurred in all prior periods need to get recorded. Management assumptions on the reasonably certain holding period may need to be examined more closely. You can use common procedures such as examining subsequent payments to lessors and reconciling reporting coming from individual lessors to lessee reporting systems to mitigate this risk. Divisional Controllers can be asked to sign off on representations that all lease activity has been reported, and there may be a requirement that no leases can be entered into the last week or two of year-end without management approval.

Best practices

Ensuring accurate and complete lease accounting disclosure reports is crucial for providing transparent and reliable financial statements. Check out the best practices to achieve this:

- Automating the lease accounting process: consider implementing a lease administration software to help automate and streamline their lease accounting processes.

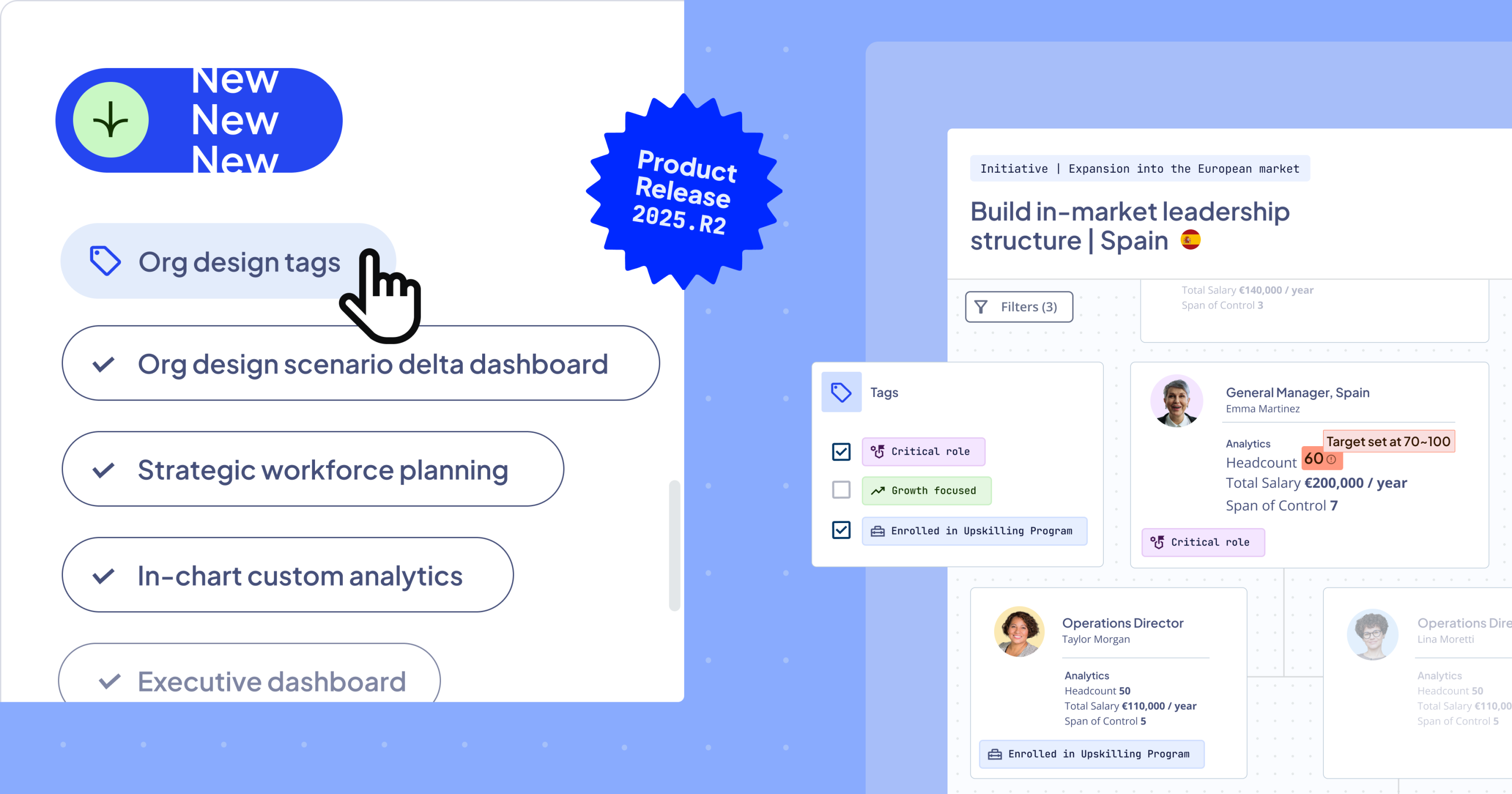

- Establishing a standardized and centralized lease accounting process: implementing a standardized and centralized lease accounting process ensures consistency in lease accounting across the enterprise. Make sure your team is developing policies and procedures for lease accounting, establishing a centralized database for lease data, and inviting all relevant departments (such as finance, legal, and operations) to the process.

- Providing regular training and education on lease accounting processes and changes in standards. Train staff on lease accounting procedures to ensure that they are informed about all changes and requirements. The staff needs to understand how the implication of these changes will affect lease accounting policies and disclosure reporting.

- Conducting regular internal lease audits will help identify any discrepancies or errors in the data and ensure that leases are being accounted for correctly.

- Maintaining accurate and up-to-date lease data throughout the year. Make sure your team has complete documentation of all lease agreements and modifications and ensure the accurate calculation of the right-of-use asset and lease liability.

By adopting these best practices, enterprises can ensure that their year-end disclosure reports are accurate, compliant, and completed on time.

4. After the audit: budgeting and planning for the next period

Now that the audit is completed, it’s a great idea to begin to budget and forecast the financial outlook of your lease portfolio. Having a comprehensive plan or budget for contract renewals, expiration dates, and critical lease events is important, especially in today’s ever-changing market where it is difficult to forecast changes.

To help you, we’ve prepared some Don’ts and Dos for budgeting future lease contracts:

Budgeting and planning don'ts

- Don't rely on information coming from multiple different sources. Matching information from different sources will create inaccuracies in reports and may carry duplicate data, which is not ideal.

- Don't generate custom reports for your budgeting. Instead, create templates that can be used for many budgeting cycles.

- Try not to perform manual calculations for budgeted lease costs. Instead, consider investing in a software tool that can automatically calculate these functions.

Budgeting and planning dos

- Collaborate with your forecasting team to determine the expected amount of cash outflows in the coming months. This will allow you to make informed decisions regarding your lease portfolio.

- Always analyze variances between actual lease costs and budgeted lease costs to ensure control over cash flows and prevent overspending on lease expenses.

- Ensure you have a plan in place for leases expiring in the short term. These dates are critical and can cost an enterprise millions of dollars if not planned properly. These leases will have to be terminated or extended, and having a budget or forecast to make these decisions is essential.

- Be aware of the authorization structure in your organization. You need to know who can approve and adjust budgets and forecasts to fit your business needs. This can help you allocate resources in the short term and spend funds appropriately.

5. Conclusion

A year-end lease administration audit is a vital process that ensures your organization's compliance with accounting standards and regulations. By implementing best practices and reconciliations throughout the year, and implementing automation for lease accounting, you can significantly streamline the audit process and reduce errors.

The year-end disclosure reports can present challenges for enterprises, but by following best practices and staying up to date on standards and requirements, you can ensure accurate and timely reporting. You can also reduce audit fees and related costs with minimal effort.

Furthermore, proper budgeting and planning for future lease contracts are critical to managing your lease portfolio effectively. By utilizing out-of-the-box reports and keeping track of variances between planned and real costs, you can ensure control over cash flows and prevent overspending on lease expenses.

Overall, by prioritizing these aspects of lease administration and accounting, your organization can maintain compliance, reduce risk, and save time and money in the long run.

Do you want to get more useful information about lease administration management at the enterprise level? Get more expert advice> or read success stories from our clients>